“I Bought My First Home at 16% Interest

Let me start with the sentence that will probably get me in trouble:

If young people spent half the time looking for ways to save and make money as they do scrolling on social media, they’d be shocked at how fast their financial life would change.

I know that sounds harsh, but sometimes the truth stings a little before it helps.

I am absolutely tired of hearing people my age say,

“Kids today can’t afford houses like we could.”

Really?

Let me tell you something.

When I bought my first home in 1979, my mortgage interest rate was 16%.

Not a typo.

Sixteen.

Percent.

And I wasn’t making six figures doing it.

I was making $9,500 a year, and my wife was a stay-at-home mom.

One income.

One used car.

One tiny savings account.

So when people my age tell young people they “can’t buy a house today,” it becomes condescending and extremely harmful — because it teaches them that they should already be living at the same level their parents are now.

That’s unrealistic.

We didn’t start out at the level we ended up at, and they won’t either — and that’s normal.

The beginning of adulthood is supposed to be the climb, not the finish line.

When older adults say, “You’ll never be able to afford a house,” young people hear:

“Don’t bother trying. The game is rigged.”

That’s not wisdom. That’s discouragement.

The truth is simple:

You can’t start out living like your parents — but if you’re willing to start lower, you can absolutely end up higher.

That’s the part nobody wants to say out loud.

How I Got Ahead (And How Young People Still Can Today)

I didn’t buy that first house by wishing.

I bought it by grinding, saving, and doing without — things anyone can still do today if they want to.

Here’s what worked for me and still works for anyone:

• I bought a used car I could afford.

No fancy rims, no payment that follows you around like a bad smell.

• I didn’t upgrade my phone every year.

Back then we didn’t have phones in our hands or our cars — they were wired to the wall in the kitchen. I get it, you need a phone today, but you don’t need the newest $1,200 model and the most expensive plan just to “stay connected.”

• I packed my lunch every single day.

Fast food is the quickest way to drain a paycheck.

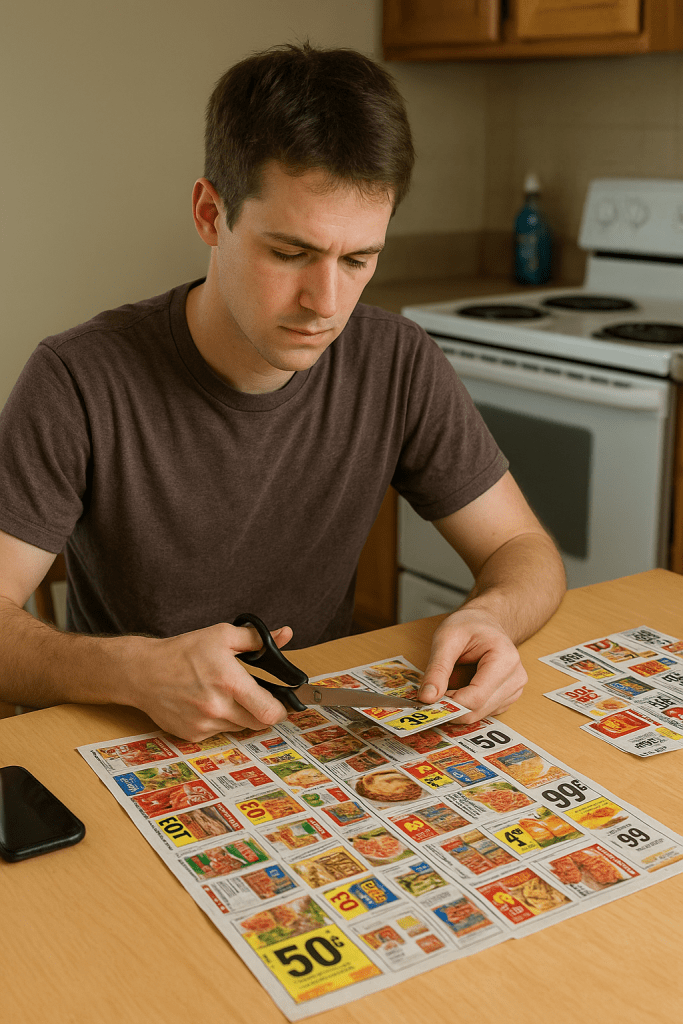

• I shopped sales and stuck to a grocery budget.

Groceries eat more money than people think.

• I didn’t use delivery apps.

No DoorDash, no Uber Eats — you’re paying triple for the same sandwich.

• I saved something from every paycheck.

Even if “something” was tiny.

• I worked second jobs.

Weekends, nights — whatever it took.

• I learned extra skills.

Anything that made me more useful made me more valuable.

• I spent my free time learning how to EARN — not scrolling.

Your thumb won’t make you rich.

• I avoided credit card debt like it was poison.

• I didn’t try to look rich.

I was too busy working to become rich.

• I lived way below my means.

Lifestyle is the biggest money trap.

• I bought used whenever I could.

Someone already paid full price for you.

• I stayed out of bars.

One night out can wipe out a week of smart choices.

• I built an emergency fund.

Even $500 makes a difference in your stress level.

• I learned to fix things myself.

No YouTube — just common sense and stubbornness.

• I negotiated everything I could.

• I shopped around for the best insurance rates.

Most people overpay because they don’t want to make phone calls.

• I lowered my rent by working at the apartment complex.

I made small repairs, helped the manager, and got a discounted rate.

Creativity beats complaining every time.

• I said no to things I couldn’t afford.

Discipline builds wealth — not impulse.

• And let me add this because it’s a big one today: I stayed far, far away from gambling apps and lotteries.

Sports betting apps, online casinos, scratch-offs, “quick picks” — they’re all built on the same idea:

you lose, they win.

It’s a tax on hope.

You can’t build a future while your money is disappearing into a slot machine on your phone.

If you want to get ahead, keep your dollars working for you, not feeding someone else’s jackpot.

Here’s the Reality: Young People Have Opportunities We Never Had

Young people today have enormous opportunities that we never had:

• side hustles

• gig work

• online businesses

• flipping on eBay

• content creation

• affiliate marketing

• remote work

• YouTube tutorials

• free online education

• the ability to make money from a phone

We had none of that.

If I wanted extra money, I had to physically go find it.

Nights, weekends, holidays — no apps, no shortcuts.

The only thing young people don’t have today is time — because they’ve replaced it with endless scrolling.

Swap just one hour a day of social media for one hour of learning, earning, or planning, and their entire life could change.

I built my life in harder circumstances, with fewer tools, making $9,500 a year while supporting a family.

Trust me — they can do it.

And the best part?

Once you learn to live below your parents’ lifestyle for a little while, everything else in life gets easier.

Discover more from Beebop's

Subscribe to get the latest posts sent to your email.